Far from perfect competition: A Look into the Market Shares of our Nation’s Leading Health Insurance Companies

Prepared by: Ellen Bloom, Jonathan Mathieu, and John Freedman.

Do you know the principal health insurance companies in your state? Take a look at the following highly concentrated markets and see which health insurance companies hold the largest market shares (with the least amount of competition).

By now, we have all heard the term “Medicare for All” as the 2020 democratic presidential primaries draw closer and more blue candidates declare their bid for the presidency. This cycle is unique  for many reasons, one being that an unprecedented number of presidential hopefuls have publicly backed the idea of a single-payer healthcare system, quite a feat considering no country in the world has ever voluntarily gotten rid of $1.2 trillion-a-year industry. With that said, Freedman HealthCare (FHC) grew curious to know the market share percentages of commercial health insurance companies across the country, particularly those facing the least amount of competition.

for many reasons, one being that an unprecedented number of presidential hopefuls have publicly backed the idea of a single-payer healthcare system, quite a feat considering no country in the world has ever voluntarily gotten rid of $1.2 trillion-a-year industry. With that said, Freedman HealthCare (FHC) grew curious to know the market share percentages of commercial health insurance companies across the country, particularly those facing the least amount of competition.

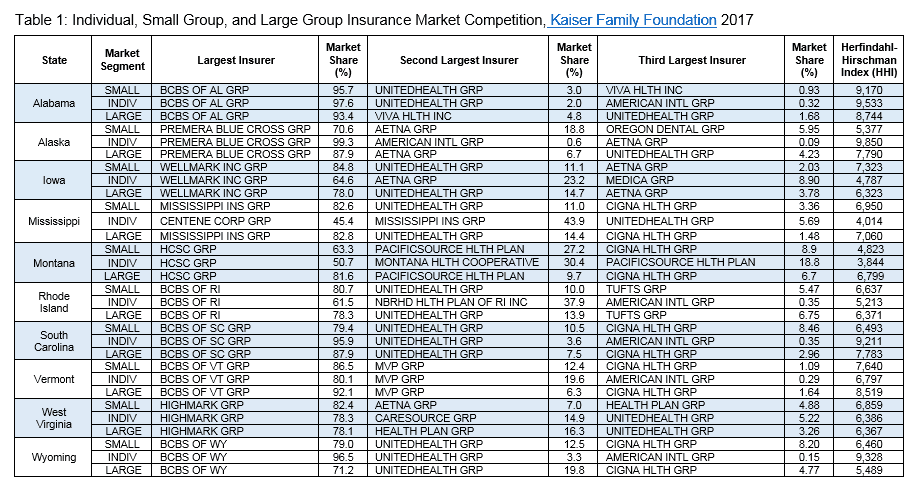

So, FHC pulled 2017 market share and enrollment data for the three largest health insurance companies within each state’s individual, small group, and large group market (KFF, 2017). Then, FHC calculated the Herfindahl-Hirschman Index for each state’s individual health insurance market and pinpointed ten states with the most concentrated markets: Alabama, Alaska, Iowa, Mississippi, Montana, Rhode Island, South Carolina, Vermont, West Virginia, and Wyoming (See Table 1).

A highly concentrated market is one where, roughly speaking, no more than four firms control the entire market. In Alabama, for example, its largest insurer, Blue Cross Blue Shield of Alabama, controls over 90% of the private health insurance market for all three of the individual, small group, and large group segments. Vermont is similar, where Blue Cross Blue Shield of Vermont has over 80% share of all three market segments. Although a few Blue plans compete head-to-head in some areas in which they operate, a Blue Cross Blue Shield plan is the largest commercial health insurer across all three of the individual, small group, and large group segments for twenty-two states (i.e. Alaska (Premera), Arkansas, Delaware (Highmark), Idaho, Iowa (Wellmark), Indiana (Anthem), Kansas, Kentucky (Anthem), Maryland (CareFirst), Michigan, Missouri (Anthem), New Jersey, North Carolina, Pennsylvania (Highmark and Independence Blue Cross Group), Rhode Island, South Carolina, Tennessee, Virginia (Anthem), West Virginia (Highmark), and Wyoming, in addition to Alabama and Vermont).

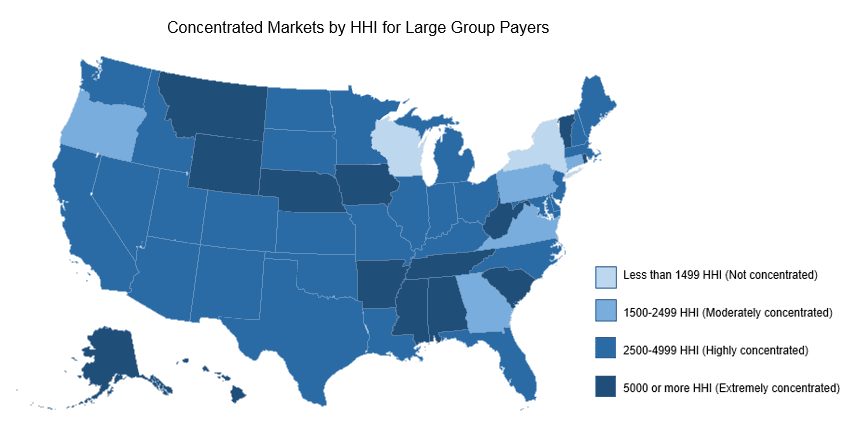

In fact, the commercial health insurance market is highly concentrated and fairly uncompetitive throughout the country. In almost every state, only a handful of commercial health insurance firms hold a piece of the pie. Just take a look at the map below showing large group health insurance market competition by HHI.

This map displays variably concentrated payer markets state-to-state. When comparing this map with the large group figures in Table 1, it makes sense that states like Alabama and Wyoming only have two or fewer commercial health insurers with at least 5% market share (since these markets are clearly highly concentrated). Of course, the states with 5-8 health insurers with that least 5% market share (i.e. Virginia, Connecticut, Pennsylvania, New York, and Washington state) have greater competition and have a lower HHI. That said, market competition may be overestimated in some of these lesser concentrated states. For example, statewide, Pennsylvania is “moderately concentrated”, however it consists of two major separate and highly concentrated markets, in the west (Pittsburgh) and the east (Philadelphia). The same can be said for New York state.

Overall, most states have 3-4 health insurance firms operating with greater than 5% market share. However, even these states are moderately to highly concentrated, averaging 1,500-2,500 HHI. Since HHI shows how evenly (or unevenly) market shares are distributed, it’s clear that large group health insurance firms across the country generally play in non-competitive markets.

So, what are the driving factors behind these widespread highly concentrated markets? A 2015 Brookings report entitled Early Assessment of Competition in the Health Insurance Marketplace found that population size and density are key determinants of insurer participation (Brookings, 2015). This explains why many of the highly concentrated commercial health insurance markets described in Table 1 overlap with some of the least densely populated regions of the country, like Alaska, Wyoming and Vermont. Additionally, mergers, tight state regulatory requirements, and the high cost of developing physician networks all help drive out the competition, which tends to lead to higher premiums for consumers and lower payments for physician services (Robeznieks, 2017).

A lack of competition in health insurer markets is not in the best interests of patients or physicians…If a health insurer merger is likely to erode competition, employers and patients may be charged higher than competitive premiums, and physicians may be pressured to accept unfair terms that undermine their role as patient advocates and their ability to provide high-quality care,” (AMA, 2015). (It’s important to note that health insurers generally have their prices (i.e., premiums) regulated by state insurance officials, in contrast to the prices of providers. In this sense, insurer consolidation may be less harmful than provider consolidation.)

What, then, is the solution? A single-payer healthcare system would strip the need of competition in the health insurance market completely, but we estimate the plausibility of a Medicare-for-All-type system is low. According to the 2017 AMA annual report, Competition in Health Insurance: A Comprehensive Study of U.S. Markets, insurers would be forced to keep premiums in check if entry were easier. In addition, the AMA suggests that empowering lawmakers and policymakers with the knowledge of potentially harmful mergers and acquisitions among private payers could help prevent further market concentration as well (AMA, 2015).

Although these solutions vary in their complexity and popularity, one thing is certain: any health care reform that is based on market principles must encourage real competition among private payers – and others – to ensure lower costs and higher quality for patients, families, employers, and providers alike.

References

American Medical Association. States Where health Insurers are Squeezing out Competition. Patient Support & Advocacy. September 8, 2015. Website. https://www.ama-assn.org/delivering-care/patient-support-advocacy/states-where-health-insurers-are-squeezing-out-competition

Henry J. Kaiser Family Foundation (KFF). Health Insurance & Managed Care. Assessed April-May 2019. Website. https://www.kff.org/state-category/health-insurance-managed-care/

Morrisey, Michael, et. al., Early Assessment of Competition in the Health Insurance Marketplace. Brookings. January 19, 2016. Website. https://www.brookings.edu/research/early-assessment-of-competition-in-the-health-insurance-marketplace/

Robeznieks, Andis. Health Insurance Markets are Highly Concentrated, New Report Reveals. Patient Support & Advocacy. The American Medical Association. October 23, 2017. Website. https://www.ama-assn.org/delivering-care/patient-support-advocacy/health-insurance-markets-are-highly-concentrated-new